Clinical Research Salary Report 2025 Average Pay by Role and Location

The clinical research industry in 2025 is experiencing a sharp recalibration of pay structures. Employers across biotech, pharma, and CROs are raising compensation to secure qualified talent as global trial activity accelerates. For professionals, this means the average salary benchmarks by role and geography have shifted significantly compared to pre-2023 norms. Companies balancing rising R&D costs with recruitment pressures are pushing pay higher, but the increases are uneven—depending heavily on job function and location.

By analyzing average pay by role and location, this report offers pure value: transparent salary ranges, regional contrasts, and the critical factors influencing compensation. Whether you’re a Clinical Research Coordinator starting out or a seasoned Trial Manager, the findings here will define what competitive compensation looks like in today’s global research economy.

Understanding the 2025 Clinical Research Salary Landscape

The clinical research salary landscape in 2025 reflects accelerating demand for professionals who can keep global trials compliant, efficient, and patient-centric. Salary growth has been most visible in high-demand roles like Clinical Research Associates and Trial Managers, with compensation benchmarks climbing faster than general healthcare averages. This isn’t just inflation—it’s a recalibration driven by funding surges, regulatory shifts, and a growing shortage of qualified experts. For employers, the pay gap between average and competitive offers has widened, forcing HR and hiring managers to adjust. For professionals, the shift means better leverage in negotiations, but only if they understand what drives these numbers.

Market Drivers Behind Salary Shifts

Several market drivers explain the salary realignment in 2025:

Decentralized clinical trials (DCTs) require staff skilled in remote monitoring, electronic data capture, and compliance with digital regulatory frameworks. This premium skill set increases pay scales for CRAs and data managers.

Regulatory complexity is at an all-time high. Countries are tightening oversight on patient safety, data integrity, and trial transparency. Professionals with regulatory expertise now command salary uplifts of 10–20% above median rates.

Funding influx from biotech startups and venture capital has intensified competition for talent. Smaller firms often pay above-market to secure experienced staff quickly.

Together, these drivers create an environment where demand consistently outpaces supply, especially for mid-senior research roles.

Global Healthcare & Pharma Expansion Impact

The expansion of global healthcare and pharmaceutical R&D is the other major salary driver. Large multinational trials are no longer concentrated in North America and Western Europe; instead, sponsors are aggressively scaling in Asia-Pacific, Latin America, and the Middle East. This shift is reshaping compensation:

In established hubs like the U.S. and Switzerland, salaries remain the highest, but growth rates have slowed.

In emerging hubs such as India and Singapore, salaries are rising 15–25% year-over-year, fueled by the influx of multinational CROs and big pharma.

Hybrid models of local staff supported by global sponsors mean even entry-level professionals are benefiting from international pay standards.

The globalization of clinical trials also means relocation packages, cross-border contract roles, and remote oversight jobs are far more common in 2025. For many professionals, this opens up opportunities to earn compensation competitive with higher-paying markets without necessarily moving countries.

Outlook for 2025 and Beyond

The 2025 salary landscape is not static—it’s evolving monthly as R&D budgets shift and pipeline investments expand. With blockbuster drugs losing patents, sponsors are doubling down on faster, leaner trials, and that efficiency push requires well-compensated talent. Expect salaries to continue trending upward in roles tied directly to trial delivery and compliance, while administrative roles see slower growth. For candidates, continuous upskilling—especially in regulatory, data, and technology—remains the clearest path to securing pay at the top quartile.

Average Salaries by Core Clinical Research Roles

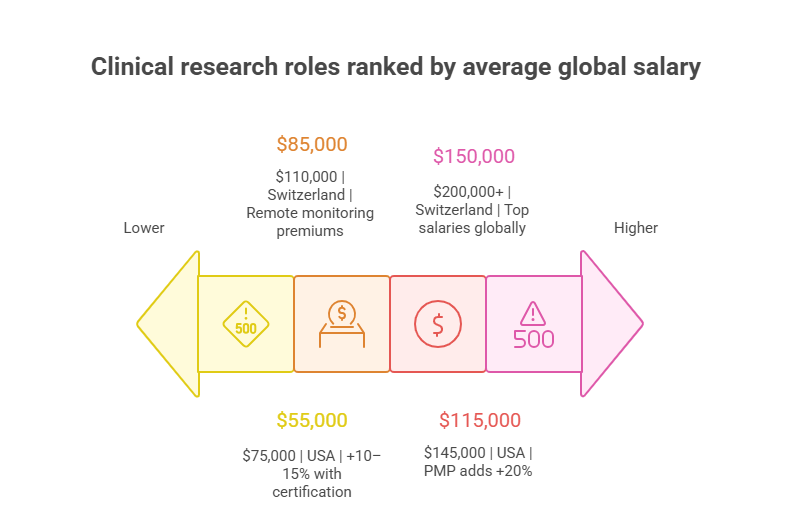

Clinical Research Coordinator (CRC)

The Clinical Research Coordinator (CRC) remains one of the most in-demand entry-to-mid-level positions in 2025. Salaries vary widely by region, but the global average now sits around $55,000–$75,000 annually, with U.S. coordinators often crossing $65,000 due to higher living costs and regulatory demands. Coordinators in emerging markets like India typically earn 40–50% lower, though year-over-year growth is accelerating as trial activity expands. CRCs with advanced certifications or dual roles in regulatory documentation often command premiums of 10–15% above median. Employers increasingly look for coordinators who can handle decentralized trial operations, making digital literacy and patient recruitment technology expertise essential drivers of higher compensation.

Clinical Research Associate (CRA)

The Clinical Research Associate (CRA) role continues to be a global salary leader among operational staff. In 2025, average pay in North America ranges between $85,000–$110,000, with senior CRAs exceeding $120,000. Europe sees strong numbers as well, with the UK and Germany averaging €70,000–€90,000, while Switzerland tops CHF 110,000. Asia-Pacific salaries remain lower in absolute terms—averaging $45,000–$65,000—but are growing fastest due to demand for regional trial oversight. Remote monitoring skills and decentralized trial management are heavily rewarded, with CRAs trained in risk-based monitoring earning 15% more. Employers face one of the highest turnover rates in this role, which further drives salary inflation and signing bonuses.

Clinical Trial Manager & Project Manager

Clinical Trial Managers and Project Managers occupy senior operational roles, bridging trial execution with sponsor oversight. Compensation in 2025 averages $115,000–$145,000 in the U.S., with Canada trailing slightly. European trial managers typically see €85,000–€110,000, while top-tier Swiss professionals can exceed CHF 140,000. Salaries in Asia-Pacific markets like Singapore and China now average $70,000–$90,000, rising quickly as local CROs scale. Managers with proven ability to deliver complex multi-country trials under budget are commanding premium salaries. The combination of leadership experience and regulatory fluency is especially valuable, with professionals holding advanced certifications or PMP credentials often earning 20% more than peers without formal project management training.

Medical Monitor & Principal Investigator

At the senior end, Medical Monitors and Principal Investigators (PIs) command the highest salaries in clinical research. Average compensation for PIs in the U.S. has surpassed $190,000 annually, with academic medical centers often offering additional research grants and stipends. In Europe, PI salaries average €130,000–€160,000, while in Switzerland they frequently exceed CHF 200,000. Asia-Pacific figures are lower but rising, with India and China averaging $90,000–$120,000, a sharp climb from five years ago. Medical Monitors, often physicians with advanced board certifications, also earn in the $150,000–$200,000 range globally. Their direct role in ensuring patient safety, data integrity, and ethical compliance makes them indispensable, securing compensation levels far above operational staff.

Salary Comparisons by Location

North America — USA & Canada

In 2025, the United States remains the global salary leader in clinical research, with Clinical Research Associates averaging $95,000–$115,000 and Trial Managers reaching $120,000–$150,000. Principal Investigators often exceed $200,000, reflecting strong demand across academic and private sectors. Canada offers slightly lower figures, with CRAs earning CAD 85,000–100,000 and Trial Managers around CAD 110,000–130,000. However, Canadian professionals benefit from better work-life balance and stronger healthcare infrastructure support. Across both countries, salaries are highest in biotech hubs like Boston, San Francisco, and Toronto, where competition for talent is fierce. Signing bonuses and retention incentives have become standard, especially in CROs competing with big pharma for experienced candidates.

Europe — UK, Germany, Switzerland

Europe’s salaries show sharp contrasts. In the United Kingdom, CRAs typically earn £45,000–£65,000, while Trial Managers make £70,000–£90,000. Germany offers higher averages—€70,000–€90,000 for CRAs and €90,000–€120,000 for Trial Managers. Switzerland remains unmatched, with CRAs earning CHF 100,000+ and Principal Investigators surpassing CHF 200,000. Switzerland’s premium is tied to its concentration of global pharma headquarters and strong R&D pipelines. Across Europe, employers are increasingly offering hybrid or remote roles, allowing professionals to work in lower-cost regions while maintaining competitive salaries. The disparity means Switzerland attracts cross-border talent from Germany and France, while the UK’s post-Brexit market is pushing companies to offer higher retention packages to prevent turnover.

Asia-Pacific — India, China, Singapore

The Asia-Pacific clinical research market is experiencing the fastest salary growth in 2025. In India, CRAs now average $40,000–$55,000, with senior roles reaching $70,000, a notable jump from five years ago. China’s rapid expansion in biotech has elevated salaries for Trial Managers to $90,000–$110,000, aligning more closely with European standards. Singapore offers some of the highest pay in the region: CRAs average $70,000–$90,000, and Project Managers often exceed $120,000, supported by government-backed R&D investments. Asia-Pacific also benefits from global sponsors outsourcing trials to the region, which inflates demand for local expertise. Relocation incentives and international project assignments have become common, helping top professionals earn packages comparable to Western peers.

Factors Influencing Compensation Packages

Education & Certification

Education and professional certification remain the strongest differentiators in clinical research salaries. A bachelor’s degree may qualify candidates for entry-level CRC roles, but advanced degrees or certifications significantly increase earning potential. Professionals holding credentials like the Clinical Research Certification from CCRPS can see salaries 15–20% higher than peers without specialized training. Employers prioritize certifications as proof of regulatory fluency and practical expertise, especially in competitive markets such as North America and Switzerland. In emerging regions like India and China, certifications can fast-track candidates into multinational CRO positions, offering compensation closer to Western benchmarks. Certifications not only validate skill but also strengthen bargaining power during salary negotiations.

Experience & Seniority

Experience continues to drive compensation across all roles. A Clinical Research Associate with 5+ years of monitoring experience often earns 30–40% more than entry-level peers. Seniority plays an equally critical role: Trial Managers with proven delivery of multi-country projects command salaries exceeding $130,000 in North America. Principal Investigators with decades of expertise, combined with published research, consistently earn at the very top of the scale. Beyond tenure, employers value demonstrable outcomes—such as successful FDA approvals or accelerated trial timelines—that directly impact revenue. Professionals who combine longevity with measurable impact achieve faster salary progression than those relying on years alone.

Company Type & Funding Stage

Compensation also depends on the type of employer and its funding stage. Established global pharmaceutical companies generally offer stable, structured pay with strong benefits. CROs, under pressure to deliver quickly, often provide competitive base salaries plus performance bonuses to attract talent. Biotech startups backed by venture capital tend to pay above-market to secure experienced staff, though packages may be weighted toward equity. Non-profit and academic centers typically pay lower cash salaries but balance with grants, research stipends, and flexible schedules. In 2025, candidates increasingly weigh total compensation—base pay, equity, bonuses, and benefits—rather than focusing on salary alone when evaluating offers.

| Factor | Impact | 2025 Trend |

|---|---|---|

| Education & Certification | +15–25% salary uplift for certified professionals | High demand for CCRPS certification |

| Experience & Seniority | 30–40% more for mid-to-senior roles | Consistent upward trend |

| Company Type & Funding Stage | Biotech startups pay above-market; academia pays less | Equity packages more common |

Future Salary Trends in Clinical Research

The future salary trends in clinical research through 2025 and beyond reflect a market that is expanding but also becoming more specialized. Employers are not only paying more but also diversifying compensation packages with performance bonuses, relocation incentives, and equity for senior hires. Unlike earlier years, salary growth is no longer concentrated in North America and Western Europe. Instead, regions like Asia-Pacific and the Middle East are seeing double-digit annual increases, reshaping global pay dynamics. Professionals who adapt to these evolving geographies stand to benefit most, particularly in trial oversight, project leadership, and regulatory functions.

Regional Growth Outlook

North America: Salary growth is stable at 3–5% annually, but already high baselines mean roles remain globally competitive.

Europe: Switzerland continues to lead, while Germany and the UK offer steady growth tied to pharma expansion.

Asia-Pacific: Salaries are rising 10–20% year-over-year, especially in India, China, and Singapore, where multinational CROs are aggressively hiring.

Middle East & Latin America: Rapid trial outsourcing is pushing salaries higher, particularly for CRAs and Trial Managers, though still below U.S. benchmarks.

Role-Specific Trajectories

CRAs: Premiums remain strongest for those skilled in decentralized and risk-based monitoring.

Trial Managers: Compensation will grow faster than inflation due to demand for cross-border leadership.

Medical Monitors & PIs: Salaries will continue to outpace all other roles, with top-tier specialists exceeding $220,000 annually in mature markets.

Skills Driving Salary Increases

The next five years will reward professionals who invest in data management, digital trial platforms, and regulatory compliance expertise. Decentralized trial adoption is accelerating, and salaries will rise fastest for those capable of integrating technology into patient engagement and data oversight. Certifications, particularly the CCRPS Clinical Research Certification, remain a differentiator, pushing pay 15–25% above median and securing advancement into leadership positions earlier in a career.

The Outlook Beyond 2025

By 2030, the clinical research market will see even greater salary alignment between East and West as globalization deepens. Professionals willing to adapt to hybrid trial models and work across borders will hold the strongest earning positions. The clear trend: salaries will keep climbing, but the biggest gains go to those who specialize and certify early.

| Region | Role | 2025 Salary Range | Trend (2025–2030) |

|---|---|---|---|

| North America | CRA | $95,000 – $115,000 | Stable growth 3–5% annually |

| Trial Manager | $120,000 – $150,000 | Steady demand, bonuses standard | |

| PI / Medical Monitor | $190,000 – $220,000+ | Top-tier roles remain strongest globally | |

| Europe | CRA | €70,000 – €90,000 | Consistent growth in UK & Germany |

| Trial Manager | €90,000 – €120,000 | Strong demand in cross-border trials | |

| PI / Medical Monitor | €130,000 – €160,000 (CHF 200k+ in Switzerland) | Continues to outpace regional averages | |

| Asia-Pacific | CRA | $40,000 – $65,000 | Fastest growth, 10–20% YOY |

| Trial Manager | $70,000 – $110,000 | Rising quickly with CRO expansions | |

| PI / Medical Monitor | $90,000 – $120,000 | Strong upward trajectory, narrowing global gap | |

| Middle East & Latin America | CRA | $35,000 – $55,000 | Rapid growth, outsourcing-driven |

| Trial Manager | $60,000 – $90,000 | Growing, still below Western benchmarks |

How CCRPS Clinical Research Certification Helps Boost Salaries in 2025

Why Certifications Boost Salaries

Certifications act as a market signal of validated expertise. In 2025, employers report paying 15–25% higher salaries to professionals with advanced credentials because they reduce training costs and ensure regulatory compliance from day one. The CCRPS Clinical Research Certification is particularly valuable, as it covers trial design, GCP compliance, monitoring, and regulatory documentation—core competencies that employers struggle to find. Candidates with this certification demonstrate job readiness and adaptability to decentralized clinical trial models. In emerging markets like India and China, CCRPS graduates often leapfrog into multinational CRO roles, achieving salaries closer to U.S. or European standards, where the certification is widely recognized.

Enroll in Clinical Research Certification at CCRPS

The CCRPS Clinical Research Certification directly impacts earning potential by aligning with employer hiring benchmarks. Certified professionals are consistently shortlisted for CRA, CRC, and Trial Manager roles over non-certified peers. In 2025, global demand for credentialed talent far outpaces supply, making this certification a differentiator in competitive regions like Switzerland, Boston, and Singapore. Beyond salary, certification enhances mobility: professionals can negotiate relocation packages or international assignments at higher pay grades. For those seeking to maximize career progression, enrolling at CCRPS offers not only salary advancement but also access to a global alumni network and structured learning modules designed by industry experts.

Frequently Asked Questions

-

The average salary for a Clinical Research Associate (CRA) in 2025 varies by location. In the United States, CRAs earn $95,000–$115,000, while senior CRAs cross $120,000. Europe sees strong compensation, averaging €70,000–€90,000, with Switzerland leading at CHF 110,000+. In Asia-Pacific, CRAs earn $45,000–$65,000, but growth is rapid as more global trials shift to India, China, and Singapore. Salaries also depend on skill set: professionals experienced in decentralized monitoring or risk-based trial management earn premiums of 15–20% above median pay. Overall, 2025 is a strong year for CRA salary growth, reflecting global demand and expanding trial complexity.

-

In 2025, the Clinical Research Coordinator (CRC) role shows wide salary variation globally. U.S. CRCs typically earn $55,000–$75,000, with urban research hubs like Boston and San Diego offering salaries at the higher end. Canada averages CAD 60,000–75,000, while European CRCs earn €40,000–€55,000. Emerging markets such as India and China offer lower averages of $25,000–$40,000, but growth is accelerating as multinational CROs expand their footprint. Coordinators with regulatory expertise or dual roles in patient recruitment and data management can earn 10–15% more than baseline averages. Certifications like the CCRPS Clinical Research Certification also increase competitiveness and salary potential across all regions.

-

The Principal Investigator (PI) and Medical Monitor positions command the highest pay in 2025. In the U.S., PIs earn $190,000–$220,000 annually, with many exceeding that when factoring in grants and stipends at academic centers. European salaries average €130,000–€160,000, while Switzerland remains the outlier with PIs surpassing CHF 200,000. Asia-Pacific averages are lower, around $90,000–$120,000, but they are rising quickly with pharma expansion. Medical Monitors, often physicians with specialty board certifications, consistently earn $150,000–$200,000 worldwide. Their critical responsibility in ensuring patient safety and data integrity makes these roles indispensable and among the most financially rewarding across clinical research.

-

Yes, regional salary disparities remain significant in 2025. North America leads, with CRAs earning $95,000–$115,000 and Trial Managers exceeding $140,000. Europe shows variance: UK CRAs average £45,000–£65,000, while Germany pays €70,000–€90,000. Switzerland is the highest-paying European hub, with Principal Investigators surpassing CHF 200,000. Asia-Pacific salaries are lower in absolute terms but growing rapidly: India’s CRAs average $40,000–$55,000, China’s Trial Managers reach $100,000, and Singapore matches mid-tier European levels with CRAs earning $70,000–$90,000. The gap is narrowing as pharma shifts more global trials to Asia. Professionals with certifications and global experience can often secure packages aligned with Western standards.

-

Certifications directly influence salary levels in clinical research. Employers prefer credentialed professionals because they bring proven expertise in GCP, trial monitoring, and regulatory compliance. The CCRPS Clinical Research Certification is widely recognized and can boost salaries by 15–25% above the median. Certified CRAs and CRCs often progress faster into managerial roles, translating into higher pay scales. In competitive markets like the U.S. and Switzerland, certifications act as tie-breakers when multiple candidates compete for the same role. In emerging regions such as India and China, certification provides access to international CRO positions, significantly lifting salary potential and opening global career pathways.

-

Salary growth in clinical research is shaped by multiple factors:

Experience: Senior CRAs with 5+ years earn 30–40% more than entry-level peers.

Education & Certification: Advanced degrees or credentials like CCRPS certification boost salaries by 15–20%.

Company Type: Pharma companies provide stable pay, while CROs and startups often offer performance-based bonuses or equity.

Geography: Professionals in Switzerland or the U.S. command the highest compensation.

Specialized Skills: Expertise in decentralized trials, regulatory compliance, or risk-based monitoring earns premiums.

Together, these factors mean professionals who strategically combine credentials, experience, and location choices see the steepest salary trajectories in 2025.

Final Thoughts

The Clinical Research Salary Report 2025 confirms that pay structures are no longer uniform but shaped by role, location, and specialized expertise. Professionals in high-demand positions such as CRAs, Trial Managers, and Principal Investigators are benefiting most from the global shortage of skilled talent. Salaries are rising sharply in Asia-Pacific while stabilizing at higher baselines in North America and Europe, creating opportunities for professionals willing to adapt globally.

Education and credentials remain the clearest accelerators of salary growth. The CCRPS Clinical Research Certification continues to differentiate candidates, unlocking salaries 15–25% above median levels and opening doors to multinational roles. For employers, this report highlights the competitive benchmarks necessary to attract and retain top talent. For professionals, it provides the clarity needed to negotiate strategically.

In 2025 and beyond, salary potential in clinical research will favor those who invest in continuous learning, adapt to decentralized trial models, and align with global demand. The landscape is dynamic, but one fact is consistent: well-trained, credentialed professionals will remain at the forefront of compensation growth, making clinical research not only impactful but also financially rewarding.