Top Emerging Markets for Clinical Trials in 2025: Comprehensive Analysis

Clinical trials are expanding into emerging markets for one reason: speed with credibility. In 2025, sponsors are hunting for countries that can deliver faster enrollment, reliable data, and predictable start up timelines without turning compliance into a nightmare. But “emerging” does not mean “easy.” The markets that win are the ones with strong investigators, scalable site networks, and clean documentation habits. If you understand where trial volume is shifting and why, you can make smarter decisions about study placement, vendor strategy, and career moves across operations, data, safety, and regulatory.

1) What “Emerging Market” Really Means in 2025 (And Why Trials Move There)

An emerging market is not just a lower cost country. In clinical trials, it means a geography where sponsors see higher marginal enrollment, more available patients, and site capacity that is not already saturated. The best emerging markets combine those advantages with mature hospital systems, capable principal investigators, and clinical teams that can run GCP-grade processes without constant monitoring rescue. The moment a market needs heavy “hand holding,” the cost advantage disappears and timelines slip.

Sponsors also move trials when specific therapeutic areas have patient concentrations that are harder to reach elsewhere. That is why feasibility is no longer a formality. It is a strategic filter. If you want feasibility thinking that matches real operations, study how different roles interact inside a trial workflow, especially the handoff points between sites, monitors, data, and safety. CCRPS role roadmaps like the clinical research assistant pathway and the clinical trial assistant career guide are useful because they show where execution breaks first.

In 2025, the pressure points that push sponsors into emerging markets are consistent. Enrollment is slower in saturated regions. Protocol complexity is rising. Dropouts are more expensive. That pushes sponsors to diversify country portfolios and build redundancy across regions. But diversification only works if data quality remains defendable. That is why clinical data management is more central than ever. Careers like clinical data coordinator and clinical data manager are growing because every emerging market expansion creates more systems, more reconciliation, and more query risk.

Safety oversight is also shaping country strategy. Markets that can support consistent safety reporting and fast case processing gain trust faster. This is one reason pharmacovigilance demand is growing globally, and why pathways like pharmacovigilance associate and drug safety specialist keep becoming more important as trials globalize.

Finally, sponsors are using a stricter lens on total cost. The cheapest country on paper is not the best if it creates amendments, deviations, missing data, or audit issues. Quality and regulatory discipline matter more in emerging markets because documentation gaps get amplified when teams work across multiple vendors. That is why regulatory and QA capability remains a deciding factor, including roles like regulatory affairs specialist and QA specialist.

2) Top Emerging Markets for Clinical Trials in 2025: How to Use the List Without Getting Burned

A country can look perfect on paper and still fail in execution. The real question is not “which market is cheapest.” The question is “which market can deliver clean enrollment and clean data under your protocol burden.” That is why the table above includes watch-outs. Those watch-outs are where budgets go to die.

To use this list intelligently, build a shortlist based on three filters.

First, match the market to the protocol’s operational load. If a trial has heavy imaging, biomarker handling, frequent visits, and strict endpoint timing, you want markets with documented discipline and stable site processes. This is where clinical data maturity matters because data reconciliation becomes a silent bottleneck. Teams that understand data workflows early reduce late queries and rework. If you want to align your team capability, use role insights from the clinical data manager roadmap and the clinical data coordinator guide, then stress test your country strategy against those realities.

Second, assess feasibility beyond “patient pool.” You need to know whether patients are already committed to competing trials, whether screening failure rates will crush timelines, and whether retention can survive the visit schedule. Sponsors that win in emerging markets invest in recruitment thinking early and validate it with high-performing research institutions. If you want a practical shortcut to understanding site ecosystems, look at reference-style lists like the top academic medical centers with active clinical trials and cross-check whether your target countries have comparable site density and investigator depth.

Third, confirm the operational controls for safety and oversight. Emerging markets can move fast, but speed is dangerous if safety reporting becomes inconsistent. If you run studies where adverse event complexity is high, your country strategy must align with pharmacovigilance capability and monitoring cadence. Career pathways like drug safety specialist and leadership routes like pharmacovigilance manager show what “good” looks like in real workflows. If you cannot picture the safety workflow end-to-end, your risk is higher than you think.

There is also a tactical truth that teams ignore: emerging markets amplify vendor and oversight quality. If you pick a weak partner, you do not just lose time. You lose control. That is why it is smart to benchmark vendors and solutions ecosystems through resources like the top CRO and research vendors buyers guide and build a vendor governance plan that a QA specialist would respect.

3) The Real Risks in Emerging Markets (And the Controls That Separate Winners From Regret)

The fastest way to fail in an emerging market is to treat it like a cost-saving shortcut instead of an execution environment. The risks are not mysterious. They are predictable, repeatable, and preventable when you build controls up front.

One risk is documentation drift. When sites are busy or under-resourced, documentation becomes delayed, incomplete, or inconsistent. That creates monitoring findings, deviations, and delayed data cleaning. The control is not “monitor harder.” The control is to design simpler workflows and build early training reinforcement that sticks. If your team is building professional discipline, use resources like creating the perfect study environment because the same discipline logic applies to site readiness, not just exams.

Another risk is vendor handoff failure. Emerging market models often involve more handoffs between local vendors, labs, logistics partners, and site teams. Each handoff is a place where accountability becomes fuzzy. The control is a clear RACI, strict escalation rules, and quality checkpoints that do not rely on heroics. QA is not “extra.” It is a survival mechanism. Role guidance like the QA specialist career roadmap helps teams understand what auditors actually look for when things go wrong.

A third risk is start-up unpredictability. Budgeting, contracting, and ethics review timelines vary. Sponsors that assume uniform start-up timelines get punished. The control is to treat start-up as a pipeline with cycle-time tracking, not a one-time hurdle. Regulatory fluency helps here, especially when trials cross multiple jurisdictions. Build perspective through the regulatory affairs specialist roadmap and the clinical regulatory specialist pathway.

A fourth risk is data fragmentation. Emerging markets can enroll fast, but if data workflows are weak, the database lock becomes slow and painful. The control is to harmonize platforms, define reconciliation rules, and enforce query discipline early. If you want to benchmark tools that support data integrity, use the top clinical data management and EDC platforms guide as a reality check when vendors promise “seamless integration.”

Finally, there is a risk that rarely gets discussed honestly: site burnout. High-performing sites get overloaded because everyone wants them. Burnout causes protocol deviations, missed windows, and patient dissatisfaction. The control is realistic enrollment planning, fair workload distribution, and practical site support. Understanding site-facing roles helps you spot burnout early, especially through role roadmaps like clinical research assistant and the site-adjacent ecosystem around investigator responsibilities like sub-investigator responsibilities.

4) How Technology Changes Emerging Market Execution in 2025 (Without Becoming a Mess)

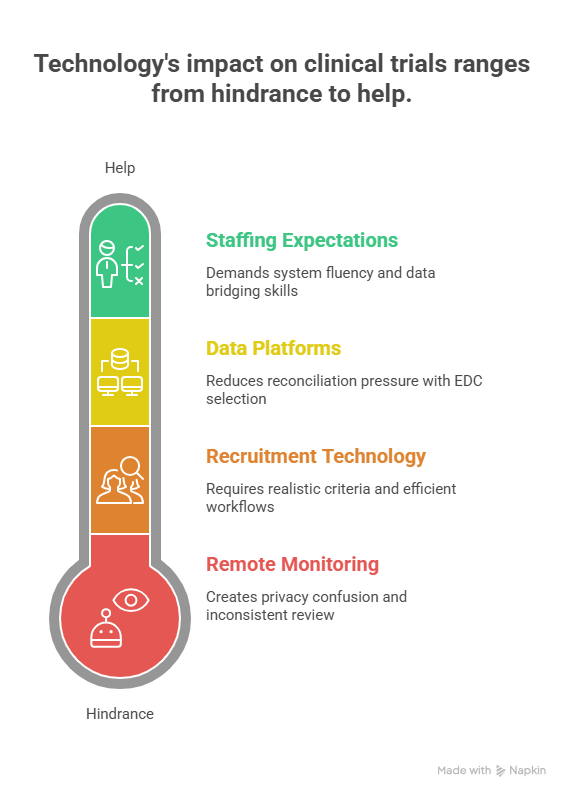

In 2025, technology can be a multiplier or a trap. Emerging markets benefit from hybrid and decentralized models when the protocol burden is high or patient travel is difficult. But DCT is not magic. Remote visits, eConsent, eCOA, wearables, and remote monitoring only work when teams define what “good” looks like. The markets that win with technology are the ones where the operational model is clear.

Remote monitoring is one of the biggest shifts because it can reduce travel and accelerate issue discovery. But it also increases demands on site documentation discipline and data access governance. If remote monitoring is used poorly, it creates privacy confusion and inconsistent review. Sponsors that win define access rules and train teams on risk-based review. If you want a platform-level view of the space, benchmark against the remote clinical trial monitoring tools guide and ensure your monitoring plan aligns with the actual site capability.

Data platforms matter even more because emerging markets add complexity. Multiple languages, multiple vendors, and variable site workflows create reconciliation pressure. That is why EDC selection and data governance become strategic decisions. If you want to understand the landscape of tools and where fragmentation hurts, use the top 100 clinical data management and EDC platforms guide. The goal is not to collect more data. The goal is to collect data that can survive review.

Recruitment technology is also expanding rapidly, but it should be treated as a controlled experiment rather than a guaranteed lever. Patient recruitment vendors can move numbers, but only if inclusion and exclusion criteria are realistic and site workflows can process candidates fast. If you want to think like a sponsor, build recruitment models that assume screen failures, staff constraints, and patient friction. Lists like the patient recruitment companies and tech solutions mega list help teams understand what is available, but the execution still comes down to workflow.

Finally, technology changes staffing expectations. Teams want people who can operate systems and troubleshoot under pressure. That is why career demand is growing for people who can bridge operations and data, especially in emerging market programs. Role pathways like lead clinical data analyst and salary views like the clinical research salary report show why system fluency is priced as a business advantage.

5) Practical Strategy: How Sponsors, CROs, and Jobseekers Win in Emerging Markets

If you are a sponsor or CRO, winning in emerging markets is a disciplined process.

Start by building a country portfolio that matches the protocol. Use a mix of high-trust execution markets and high-enrollment expansion markets so you do not get trapped by a single region’s delays. Then invest in site selection quality. A smaller number of high-performing sites beats a larger number of average sites, because average sites create rework and slow data cleaning. If you need a grounded view of CRO and vendor ecosystems, benchmark against the contract research vendors and solutions guide and avoid choosing partners based on branding instead of performance.

Next, treat safety and data as core operations, not downstream tasks. When emerging markets enroll fast, safety case volumes increase quickly. If your case processing pipeline is weak, you lose control. This is why pharmacovigilance pathways like pharmacovigilance associate and drug safety specialist are relevant even to operations leaders. Safety failures become operational failures.

Regulatory and quality controls should be built early. That includes country-specific documentation discipline and vendor oversight rules that a regulatory affairs associate would recognize as credible. If you wait until after problems appear, you will pay for it in delayed milestones and reputational damage.

If you are a jobseeker, emerging markets create opportunity because global programs need people who can execute across time zones and workflows. But the hiring filter is still fundamentals. The fastest path to credibility is proving you understand GCP-aligned execution and documentation habits. Use study systems like proven test-taking strategies and build discipline through the right study environment. Then choose a specialization aligned with bottlenecks such as data, safety, regulatory, or monitoring.

To align with demand, follow salary signals and role roadmaps. The clinical research salary report, the CRA worldwide salary data, and specialty tracks like pharmacovigilance salary trends help you see where skills are being bought aggressively.

6) FAQs: Emerging Markets for Clinical Trials in 2025

-

Markets with large patient pools and strong urban hospital networks often deliver faster enrollment, but “fast” depends on the indication. India, Brazil, Mexico, and parts of Eastern Europe can perform well when sites are selected carefully. The real differentiator is feasibility accuracy and site process maturity. If data workflows are weak, fast enrollment turns into slow database lock, which is why understanding data roles like clinical data coordinator matters. Pair enrollment goals with monitoring controls and data governance from day one.

-

The biggest hidden risk is control loss through vendor handoffs. Emerging markets often require more local partners, which increases accountability gaps. When ownership is unclear, deviations and documentation issues grow quietly until audits or database deadlines expose them. Strong quality systems reduce this risk, which is why pathways like the QA specialist roadmap are not just career content. They explain the oversight mindset that prevents damage. Control is the real cost advantage.

-

Preventing data problems starts with platform discipline and training reinforcement. Use fewer systems when possible, define reconciliation rules early, and enforce query turnaround expectations. Teams should pick tools that support integration rather than create fragmentation. Benchmark platforms with the top clinical data management and EDC platforms guide. Then staff the trial with people who know how to protect data integrity, which is why roles like clinical data manager keep gaining leverage.

-

They can be, but only when the operational model is clear. Hybrid methods reduce patient travel burden, but they also introduce device issues, access governance challenges, and more vendor coordination. Remote monitoring can help if sites are trained and documentation is consistent. If you are evaluating the ecosystem, reference the remote monitoring tools guide and ensure your plan fits site realities. Hybrid works when it is controlled, not when it is trendy.

-

The roles tied to global execution bottlenecks benefit most. Data integrity, safety oversight, regulatory execution, and quality systems are all in higher demand as trials globalize. That includes pathways like drug safety specialist, pharmacovigilance associate, regulatory affairs specialist, and clinical data coordinator. These roles protect timelines and credibility, so demand stays strong.

-

Use a three-step evaluation. First, feasibility realism: screen failure, competing trials, retention risk. Second, operational maturity: documentation discipline, staffing stability, query responsiveness. Third, oversight strength: vendor governance, QA checkpoints, regulatory navigation. Then validate your decision by checking whether you can staff the program with strong operators and whether your vendors are proven. Resources like the top CRO and solutions vendor guide help you avoid weak partners. A market is “worth it” when it increases speed without increasing chaos.