Global Clinical Trial Market Report: Growth Projections and Analysis for 2026–2030

The global clinical trial market is entering a phase where execution wins more than ambition. From 2026 to 2030, growth will be driven by faster study designs, smarter trial operations, and a hard shift toward evidence that can survive regulators, payers, and real world outcomes. But the biggest story is not “more trials.” It is more complexity per trial. If you understand where budgets move, why timelines slip, and which roles become bottlenecks, you can predict winners across sponsors, CROs, sites, and career paths.

1) 2026 Baseline: What the Global Clinical Trial Market Really Looks Like Now

In 2026, the market is shaped by a few forces that keep repeating across every sponsor and CRO boardroom: time-to-enrollment, protocol complexity, and data confidence. When sponsors talk about growth, they are quietly talking about how to stop burning budget on delays that feel “normal.” The gap between planned and actual enrollment is still the most expensive failure mode, which is why patient recruitment ecosystems keep expanding and why teams obsess over feasibility earlier than ever. If you want the most grounded view of trial economics, track where the workflow breaks first, not where the headlines point.

A second reality is that “more technology” has not automatically produced better trial delivery. Sponsors have bigger stacks, but fewer people who can run them cleanly. That makes clinical data management and EDC strategy a strategic advantage, not a back office function, which is why roles like clinical data manager and lead clinical data analyst keep gaining leverage inside teams. When data quality drops, everything else becomes a debate, including safety.

Safety pressure is also rising because regulators and internal governance teams are less tolerant of weak narratives. Pharmacovigilance is not just a downstream activity anymore. It is a system that can shape study decisions in real time, and that is why career tracks like pharmacovigilance associate and drug safety specialist are getting pulled closer to strategy instead of staying purely operational. When you connect clinical operations and safety early, you reduce rework, reconsent chaos, and late stage surprises.

If you want to understand the market baseline in one sentence, it is this: global clinical trial spend is growing, but so is the cost of being sloppy. Careers, vendors, and sponsors that can prove operational control will win disproportionately, especially when hiring managers use salary signals as a proxy for criticality. Use pay trends as a reality check through resources like the clinical research salary report, CRA salary data, and specialized verticals such as pharmacovigilance salary trends.

2) 2026–2030 Growth Projections: Drivers, Headwinds, and What Actually Moves the Market

If you want a useful projection, stop treating the clinical trial market as “one number.” Growth will come from volume, complexity, and new evidence requirements. Volume increases when pipelines expand. Complexity increases when endpoints, data sources, and safety oversight multiply. Evidence requirements increase when payers and regulators expect stronger proof of value, not just statistical significance. That is why the market grows even when trial counts feel flat, because the operational load per program rises.

The most reliable growth driver is the shift toward specialized programs that are harder to run. Rare disease trials, oncology expansions, gene and cell therapies, and complex chronic disease studies often demand higher-touch operations, intensive monitoring, higher data density, and more safety vigilance. That pulls demand toward sophisticated operational teams, strong vendors, and experienced monitors, which is why CRA compensation remains a consistent signal of where bottlenecks live. Use salary baselines like the CRA global salary report, the CRC salary guide, and the broader clinical research salary report to see where skills are being priced like scarce resources.

Headwinds are less glamorous but more predictive. The biggest one is enrollment friction, because it multiplies downstream costs. Another is the “tool stack paradox.” Teams buy platforms, but cannot integrate them, govern them, or train staff fast enough. That causes query backlogs, reconciliation mess, and delayed database locks. This is exactly why clinical data careers remain resilient and why readers should understand the advancement logic in the clinical data coordinator career path and the clinical data manager roadmap. You do not need to be a programmer to win here. You need to be the person who makes the system behave.

A third headwind is compliance and oversight. Regulators do not accept “we outsourced it” as a defense when vendor controls fail. That is why regulatory and QA functions are expanding in influence, not shrinking, and why roles like regulatory affairs specialist and QA specialist remain core to long-term scale. When a sponsor grows globally, regional regulation differences can create invisible delays that only experienced regulatory teams can prevent.

The strongest projection you can make for 2026–2030 is not a CAGR claim. It is a workflow claim: trials will move toward models that reduce site burden, increase data credibility, and speed decision-making. If you align your skills or your vendor strategy with those workflow goals, you ride the market rather than chasing it.

3) Where Growth Concentrates: Regions, Therapeutic Areas, and the New “Demand Hotspots”

From 2026 to 2030, growth will not distribute evenly. Regions with strong site networks, stable regulatory pathways, and deep investigator ecosystems will keep attracting global trial volume. At the same time, sponsors will continue expanding into regions that offer faster enrollment or cost advantages, as long as data quality and compliance remain defendable. The practical result is that the “global” market becomes more fragmented operationally. You can run one protocol globally, but you cannot manage it with one mental model.

Therapeutic concentration is another predictable reality. Oncology remains a major driver, and so do immunology and neurology, but the more important insight is that certain therapeutic areas create specific operational bottlenecks. In complex indications, investigators are scarce, screen failures are high, and retention is fragile. That increases demand for patient recruitment partners, site relationship management, and coordinators who can run clean workflows. If you want to understand where operational intensity will be highest, look at pipelines where endpoints require longer follow-up, more specialized diagnostics, or high-frequency patient contact.

Safety and pharmacovigilance scale alongside this complexity. As trials become more global and patient populations become more medically complex, the safety narrative becomes harder to defend without strong processes. That is why market growth pulls PV along with it, and why career pathways like how to become a pharmacovigilance manager matter to readers who want leadership roles. Even if you are not in PV, you benefit from understanding safety workflows because safety issues are one of the fastest ways to derail timelines and budgets.

Now layer in the vendor side. The market is not only sponsors and CROs. It is also a rapidly expanding ecosystem of platforms, recruitment providers, monitoring tools, and data solutions. If your goal is to make decisions like a sponsor or to build a career advantage, study the vendor landscape rather than guessing. CCRPS maintains deep directory style references such as top 50 contract research vendors, top 50 remote trial monitoring tools, and top 100 clinical data management platforms. A major 2026–2030 advantage is knowing which vendors solve real problems and which ones just look good in demos.

A final hotspot is talent and training. Market growth requires people who can run SOP-based operations under pressure. When hiring managers cannot find that talent, they pay more, outsource more, and accelerate training pipelines. That is why certification and exam readiness remain a practical lever, not a decorative line on a resume. If you want to build reliable study systems, learn from resources like creating the perfect certification study environment and proven test-taking strategies.

4) The Operating Model Shift: Decentralized Trials, Risk-Based Quality, and the “New Default”

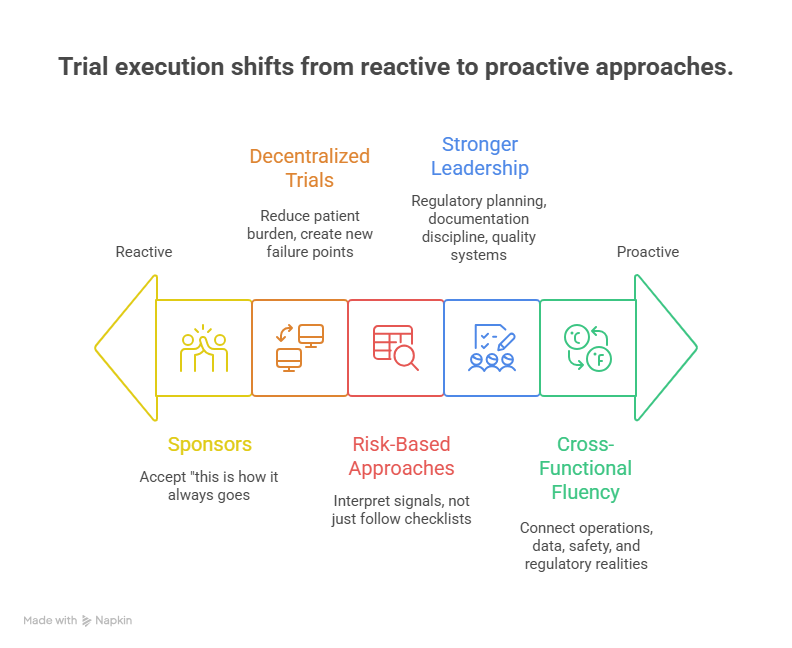

Between 2026 and 2030, the biggest change is that trial execution becomes more intentional. Sponsors are less willing to accept “this is how it always goes.” They want predictable start-up, predictable monitoring, and predictable data quality. That pushes the market toward hybrid and decentralized trial methods, risk-based monitoring, and stronger quality frameworks. But the important part is not the buzzwords. It is the operational tradeoffs.

Decentralized trials can reduce patient burden, but they can also create new failure points: device issues, missing data, inconsistent processes across regions, and vendor chaos. The organizations that win are the ones that treat decentralization like an operating system. They define what must stay on-site, what can be remote, how data is validated, and how issues escalate. If you want to understand the tool landscape that supports these models, do not rely on one vendor’s marketing. Benchmark against resources like top 50 remote monitoring tools and consider how those tools interact with EDC and data workflows listed in the top 100 EDC and CDM platforms guide.

Risk-based approaches also reshape roles. When teams move away from blanket SDV, they need people who can interpret signals, not just follow checklists. That increases the value of CRAs who understand critical-to-quality thinking and data review logic. It also increases the value of data professionals who can make issues visible before they become deviations. If you are building a career, this is why aligning with data and monitoring bottlenecks is so powerful, whether you aim for clinical data manager or an operations-focused path that supports investigators and sites.

The market also demands stronger leadership in areas many teams underinvest in: regulatory planning, documentation discipline, and quality systems. In high-growth environments, weak documentation becomes a hidden tax, because it triggers rework, findings, and slower approvals. That is why regulatory and quality content remains relevant across markets, including clinical regulatory specialist, regulatory affairs associate, and QA specialist.

Finally, operating model shifts increase the demand for cross-functional fluency. The teams that move fastest are the teams that can connect operations, data, safety, and regulatory realities into one plan. If you can speak across those domains, you become harder to replace. Learning adjacent workflows through CCRPS role guides such as clinical research assistant and clinical trial assistant is a practical shortcut because it shows how trial work actually flows from one role to another.

5) What the Market Means for Careers and Hiring: Where Demand Will Be Highest in 2026–2030

Market growth is not only about spend. It is also about who gets hired, who gets promoted, and who gets stuck. The fastest-growing demand clusters align with bottlenecks: data integrity, safety oversight, regulatory execution, and site performance. If you want a career that benefits from market growth rather than suffering from it, target roles that protect timelines and protect credibility.

Clinical data is one of the clearest demand engines. As trials add more data sources, sponsors need people who can keep datasets consistent and analysis-ready. That is why career pathways such as clinical data coordinator and lead clinical data analyst remain durable, and why platform awareness matters. If you understand what good data looks like, you become the person teams depend on to avoid late-stage panic.

Pharmacovigilance and drug safety are also gaining power. Safety functions can no longer be treated as a separate world that only speaks up when there is an event. In complex trials, safety review cadence influences operational decisions. That is why readers who want stability should look at PV pathways such as pharmacovigilance associate, drug safety specialist, and leadership targets like pharmacovigilance manager. This is also one of the areas where remote work options are expanding, which is why directory resources like remote PV case processing jobs matter to jobseekers.

Regulatory and QA roles become more influential in high-growth environments because speed without compliance is fragile. Sponsors expanding into new regions need people who can prevent documentation collapse and guide teams through local expectations. That makes career paths like regulatory affairs specialist and QA specialist a practical hedge against market volatility. When trial volume shifts, compliance still stays.

If you are early in your path, the market rewards you for building fundamentals fast. Hiring managers do not need you to “know everything.” They need you to show that you understand real workflows, documentation standards, and how to avoid mistakes that cost weeks. That is why structured study systems and exam confidence remain a career advantage, especially when combined with role clarity and a consistent study plan. Use resources like study environment building and test-taking strategies as practical tools rather than motivational content.

Finally, do not ignore the “career adjacency” effect. Many people enter clinical research through adjacent roles and then specialize. CCRPS role roadmaps like principal investigator and sub-investigator matter because they explain responsibility boundaries that shape trial delivery. Understanding these boundaries makes you better at collaboration, which increases your value in any role.

6) FAQs: Global Clinical Trial Market Growth and What to Do About It (2026–2030)

-

The biggest driver is not just “more trials.” It is the rising operational load per program. Trials are adding more endpoints, more data sources, and more safety oversight, which increases required staffing, vendors, and time. This complexity also increases the value of strong data and safety functions, which is why roles like clinical data manager and drug safety specialist expand. If you want to predict growth, watch protocol amendments, enrollment friction, and data governance needs. Those forces quietly determine spend.

-

Often they move costs rather than eliminate them. Hybrid models can reduce patient burden and improve retention, but they introduce new vendor coordination, data validation, and operational oversight needs. If the study team does not define clean workflows, decentralization can create missing data and reconciliation issues that delay database lock. That is why understanding the tool ecosystem matters and why resources like remote monitoring platforms and EDC platforms are useful. The win is not decentralization. The win is controlled decentralization.

-

Regions with strong site infrastructure, efficient start-up pathways, and reliable investigator networks tend to attract ongoing volume. But sponsors also expand into new regions when enrollment speed becomes urgent. The tradeoff is that regional expansion increases compliance complexity and vendor oversight needs. That is why regulatory and quality roles stay critical across geographies, including regulatory affairs specialist and QA specialist. Growth follows feasibility, but durability follows compliance.

-

Roles tied to bottlenecks are the most protected. Data integrity roles remain durable because every trial needs clean, defendable datasets, which supports paths like clinical data coordinator and lead clinical data analyst. Safety roles remain durable because complex patient populations create more monitoring and reporting needs, which supports pharmacovigilance associate. Regulatory and QA also remain durable because oversight expectations do not relax when budgets tighten.

-

Start with workflow clarity and proof of fundamentals. Learn how trials move from start-up to enrollment to monitoring to closeout. Then build evidence that you can execute, not just “study.” CCRPS role guides like clinical research assistant and clinical trial assistant show practical responsibilities you can map to skills. Build a consistent study environment using this study setup guide and sharpen exam performance with these test-taking strategies. Most beginners fail from scattered prep, not lack of ability.

-

Predictability comes from reducing rework. That means aggressive feasibility discipline, fewer protocol amendments, clear vendor oversight, strong data governance, and early safety integration. If you build these foundations, you reduce the “late-stage panic” that destroys timelines. It also means investing in roles that keep operations stable, like clinical data management, quality assurance, and regulatory pathways. The market rewards teams that can prove control.

-

Yes, if you want a role tied to long-term growth drivers. As trials become more global and complex, safety oversight becomes more central. Sponsors need faster case handling, stronger signal detection discipline, and cleaner audit trails. That supports entry pathways like pharmacovigilance associate, progression through drug safety specialist, and leadership through pharmacovigilance manager. If you want remote flexibility, explore structured options like remote PV case processing roles.